GST implementation in India transformed the country’s indirect tax landscape. According to government records, this reform replaced multiple fragmented central and state levies. The new system created a unified national market for goods and services.

The Goods and Services Tax subsumed 37 different central and state taxes. It provides Input Tax Credit across the entire supply chain. This comprehensive guide explains how the GST system works in practice.

Understanding the difference between CGST, SGST, and IGST forms the foundation of GST compliance. Businesses must know which component applies to their transactions. This knowledge ensures proper tax calculation and filing.

Understanding GST Implementation in India

GST represents the biggest tax reform in India’s history. The reform unified indirect taxation across all states and union territories. It eliminated barriers that previously restricted the free movement of goods.

Historical records confirm that the implementation of GST in India followed years of preparation. The Kelkar Task Force first suggested a comprehensive GST in December 2002. The Union Budget 2006-07 formally announced the introduction of GST.

When Was GST Implemented in India

When was GST implemented in India? The Parliament passed the Constitutional Amendment Act in September 2016. The Constitution (One Hundred and First Amendment) Act received Presidential assent on 8 September 2016.

GST was rolled out with effect from 1 July 2017. Jammu and Kashmir joined on 8 July 2017, following the passage of state legislation. The launch ceremony took place in the Central Hall of Parliament on 30 June 2017.

The Empowered Committee of Ministers prepared the background material for GST. Business Process Documents on Registration, Payment, and Refund entered the public domain during 2015. The model GST Acts were placed in the public domain in June 2016.

Taxes Subsumed Under GST

GST absorbed numerous central taxes into the new framework. Central Excise Duty was merged, except for certain petroleum and tobacco products. Service Tax, Additional Excise Duty, and Countervailing Duty all became part of GST.

State taxes also joined the unified system. State VAT and Sales Tax merged into GST for most goods. Entertainment Tax, Entry Tax, Octroi, Purchase Tax, and Luxury Tax are all subsumed into the new structure.

Certain items remained outside the GST framework. Petroleum products, including crude, diesel, petrol, natural gas, and aviation fuel stay excluded. Alcoholic liquor for human consumption also remains outside the GST ambit.

Source:Tax2win

Difference Between CGST, SGST, and IGST Explained

The difference between CGST, SGST, and IGST determines how tax revenue gets distributed. Each component serves a distinct purpose in the federal tax structure. Understanding these components ensures correct tax application.

CGST, SGST, and IGST together form the complete GST framework. The applicable component depends on whether supply occurs within or across state boundaries. This dual structure maintains both central and state taxing powers.

CGST SGST IGST Full Form and Meaning

CGST stands for Central Goods and Services Tax. The Central Government collects this tax on supplies within a state. It represents the central share of the total GST rate.

SGST means State Goods and Services Tax. The respective State Government collects this component. UTGST applies in Union Territories without their own legislature.

IGST refers to the Integrated Goods and Services Tax. The Government of India levies this on inter-state supplies. It also applies to imports into India.

How Each Component Applies

For intra-state supplies, both CGST and SGST apply simultaneously. Each component equals half the total applicable GST rate. For example, an 18 percent GST rate means 9 percent CGST plus 9 percent SGST.

IGST applies to all inter-state supply of goods and services. The full GST rate applies as IGST in such cases. IGST gets apportioned between the Union and States under the IGST Act.

Input Tax Credit flows seamlessly across all components. Businesses can use IGST credit against CGST, SGST, or IGST liability. This mechanism prevents tax cascading throughout the supply chain.

GST Tax Structure and Registration Requirements

The GST tax structure uses multiple rate slabs for different categories. Government documentation confirms that four major tax slabs currently operate. These rates apply uniformly across all states in India.

The standard GST rates are 5 percent, 12 percent, 18 percent, and 28 percent. Certain luxury and sin goods face additional GST Compensation Cess. This includes cars, tobacco products, pan masala, and aerated drinks.

Current Tax Slabs and Special Categories

Gold attracts a special 3 percent GST rate. Precious stones face a 0.25 percent rate. Several essential goods and services remain exempt from GST entirely.

Exports are zero-rated under the GST structure. Exporters can claim refunds for taxes paid on their inputs. This maintains the competitiveness of Indian exports globally.

Some products attract multiple rates based on value thresholds. Historical records show that footwear was taxed differently below and above certain price points. Similar variations exist for readymade apparel and hotel tariffs.

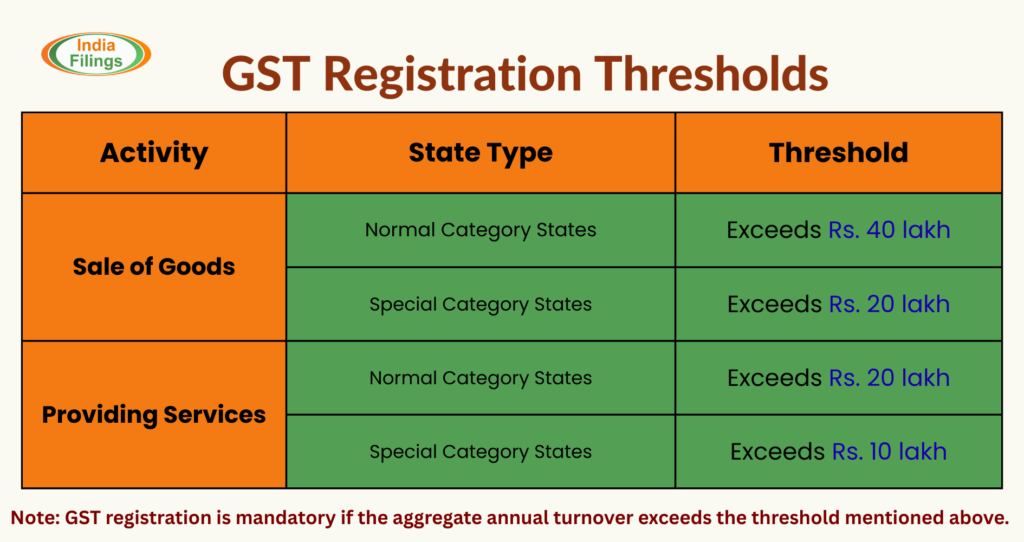

Threshold Limit for GST Registration

The threshold limit for GST registration determines mandatory compliance requirements. Businesses with an annual turnover above INR 2 million must register. Special category states have lower thresholds of INR 1 million.

The GST registration threshold varies based on business type and location. Service providers in regular states need registration above an INR 2 million turnover. Goods suppliers in special category states have different limits.

Taxpayers between INR 2 million and INR 15 million can choose the composition scheme. Under this scheme, they pay tax on turnover rather than value added. Composition dealers pay 5 percent for restaurants, 2 percent for manufacturers, and 1 percent for others.

Businesses above INR 15 million must charge GST at prescribed rates. They can deduct GST paid on purchases through Input Tax Credit. This full compliance requirement applies regardless of business category.

Source: Indiafilings.com (Updated on: Dec 27, 2025)

GST Network and Compliance Framework

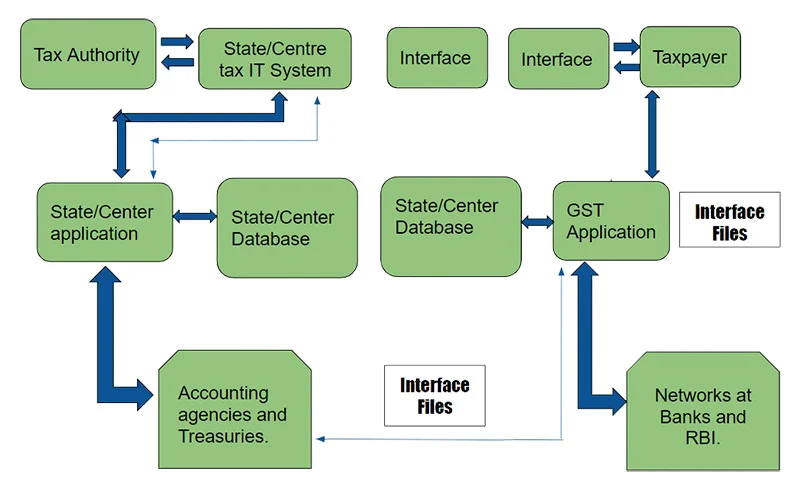

The GST Network GSTN provides the technology backbone for the entire system. According to official records, GSTN was registered on 28 March 2013. It operates as a not-for-profit organisation under Section 8 of the Companies Act.

GSTN offers a common IT infrastructure to all stakeholders. The Government of India holds 24.5 percent equity. All state governments together hold another 24.5 percent stake.

GSTN Portal Functions

The portal handles taxpayer registration and verification processes. It manages invoice uploads, payment processing, and return filing. The system enables Input Tax Credit reconciliation across the supply chain.

All GST returns must be filed through the GSTN portal. The system captures transaction data and allows verification of ITC claims. Risk-based selection helps identify cases for detailed audit.

The original design envisaged invoice-level matching for all transactions. GSTR-1 captures outward supplies made during each tax period. GSTR-2A auto-populates from suppliers’ GSTR-1 filings for verification.

Return Filing and Compliance

GST return filing follows a structured timeline for all registered taxpayers. The system requires uploading of invoice-level information. This enables verification and auto-population of Input Tax Credit details.

GSTR-3B serves as the self-assessed summary return for tax payment. Taxpayers file a single return covering CGST, SGST, IGST, and Compensation Cess. The system aimed for system-verified ITC based on matched invoices.

Cross empowerment allows both central and state officers to administer GST. Taxpayers obtain separate registration in each operating state. A single challan is generated for paying all GST components under each registration.

Source: Tax2win

Conclusion

GST implementation in India created a unified indirect tax system across the nation. The reform subsumed 37 central and state taxes into one framework. This transformation established a common national market.

Understanding the difference between CGST, SGST, and IGST remains essential for compliance. Intra-state supplies attract both CGST and SGST at equal rates. Inter-state supplies face IGST at the full applicable rate.

The threshold limit for GST registration starts at INR 2 million for most businesses. The GST tax structure offers multiple rate slabs from 5 to 28 percent. The GST Network GSTN enables electronic filing and verification.

Businesses must maintain proper compliance with registration and return filing requirements. The Input Tax Credit mechanism prevents tax cascading through the supply chain. This system continues evolving based on GST Council recommendations.